Summary:

- NextEra Energy’s ‘Real Zero’ plan is driving growth and revenue model sustainability, poised to increase net income by 10% and expand market share by 8%.

- With a 1Y Forward price target of $71.29 and 25% upside, NextEra Energy is a BUY for growth-oriented investors.

- While the re-evaluation of subsidiaries has led to a fairer share price for NEE, investors should continue to pay close attention to management guidance and the current policy backdrop.

kitiwan mesinsom

While utilities rarely attract growth potential, plans for rapid expansion into renewable energy make NextEra (NYSE:NEE) a clear outlier, where both a limitless source of power and capital potential come together for a great investment.

Renewables have become an increasingly significant power player in the regulated utilities industry, with firms like NextEra Energy leading the charge with their ‘Real Zero’ plan. The company could soon see a 10% projected increase in Net Income, driven by an 8% increase in market share attributable to integrating new energy sources and a subsequent reduction in COGS. With investors finally rethinking their projections and toning down their sky-high valuations with subsidiary NEEP’s revisions, now is the perfect time to buy, with a price target of $71.29 and a roughly 25% upside.

Company Overview

NextEra Energy is a leading renewable energy company in the utility, solar, and wind power sectors. As one of America’s largest regulated utility providers by both market cap (135.3B,-19%YoY) and service reach (~6M customer accounts), the company is well positioned for sustained revenue growth, especially considering its role as a public benefit provider.

Although revenue for the overall utility market is worth well over $1.1T, estimates for growth show a slowdown in earnings, with market research by IBIS showing a lacking 0.1%YoY FWD revenue increase (in comparison to .7% during 2018-23). While headwinds include a lack of growth in generation capacity and rising residential electricity prices due to post-pandemic inflation, investors should instead zoom in on NextEra’s growing market share within the industry and increasing exposure to renewable tech.

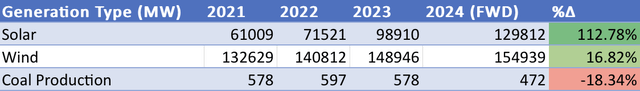

Phi Fiscal / Data: US Energy Information Administration

With an investment totaling a remarkable $80B in Capex focused on the ‘Real Zero’ program (2X more than Southern Company, the closest competitor by Market Cap), NextEra has gained a solid foothold in the renewables sector.

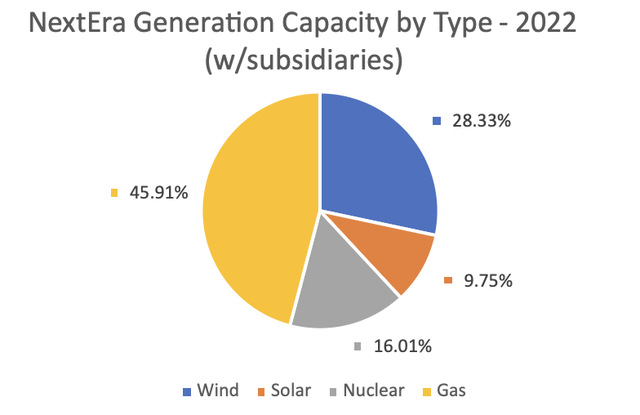

In the solar energy industry, NextEra holds a 14.2% market share, with ConEd controlling 41.7% and the other 44.1% diversified. Although NextEra’s share of this specific generation market has slightly declined in recent years, that is more so due to the participation of new entrants and the overall growth of the market, not necessarily poor operations on NextEra’s side.

In the wind energy market, NextEra leads the market with a 1.7% share, with the other 97.2% diversified. This represents NextEra’s lowest market share of any of their main markets, even though they are the market leader.

Combined, the overall renewable energy market paints a picture of high competition with reasonable regulatory barriers to entry, something NextEra will capitalize on well, as they have the most significant planned CapEx expansion of any firm in that sector.

Catalysts

Without taking into account positive policy backdrops, such as President Biden’s Inflation Reduction Act granting $40B in loan authority to renewable energy projects, NextEra’s “Real Zero” program will serve as a significant catalyst driving a positive boost in market share and an expansion in margins as a runoff result.

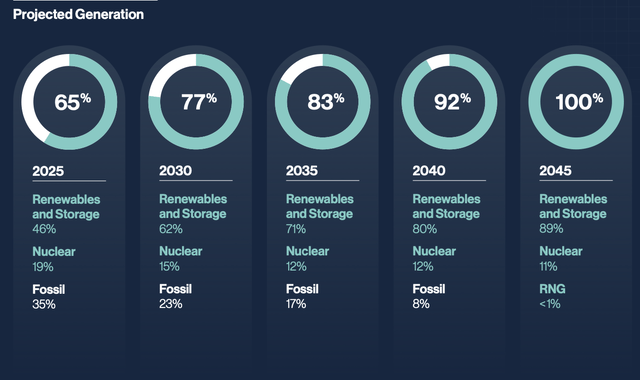

NextEra Energy

With Real Zero marking a dedicated plan to reach 89% (100% zero emission) renewable generation by 2045, most improvements will occur in the next five years. NextEra is set to expand its current renewable generation capacity by 8% FY24, from 38% to the 46% projected above. For context, we define renewable energy as consisting solely of solar and wind since nuclear plants rely on a finite source of uranium.

To this end, efforts are already being undertaken to double its solar capacity from 7 to 14%, and additional investments have been made in wind power.

Phi Fiscal / NextEra Energy 10K

Such improvements under the Real Zero plan will ultimately increase market share by placing it in line with the growing wind and solar utility industries, which have a forward CGAR of 3.2% and 13.7%, respectively. With OPEC+ setting yet another quota on oil, demand for renewable energy as a substitute will only grow with these tailwinds, supporting projections for rapid growth of the industry.

It is also vital to mention that this growth in renewables will expand margins by significantly reducing COGS (specifically Fuel and Purchased Power), as the company moves away from oil and natural gas. Research by Bloomberg and the International Energy Agency show that the cost to produce and maintain renewable energy is 40% cheaper than fossil fuels, which we took into account when conducting our valuations.

Valuation

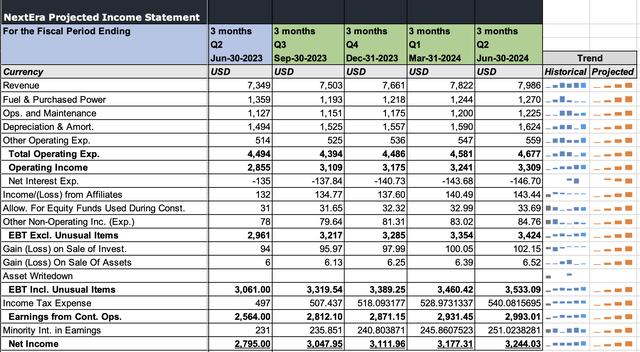

Assuming an 8% increase in renewable generation capacity FY24 based on NextEra’s “Real Zero” plan and a subsequent translation into increased market share for these industries, NextEra is set to have a forward 2.1% revenue growth trend attributable per quarter.

Combined with a subsequent decrease in COGS with a reduction in Fuel and Purchased Power by 15% (as renewables make up ~38% of generation capacity), net income is set to increase Q4 by approximately 10%, placing it in line for sustained growth by year’s end.

Phi Fiscal / Data: Seeking Alpha, StockAnalysis, NextEra 10K

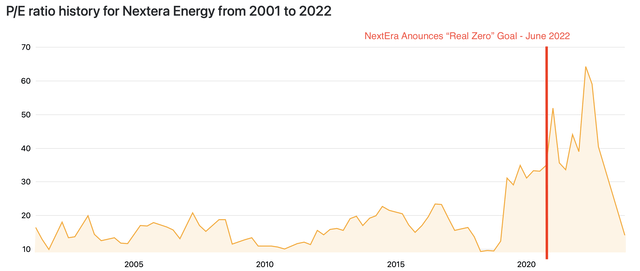

With roughly 2B shares outstanding, this gives us an EPS of $1.52 (10%+ QoQ, 76%+ YoY). Holding an average P/E ratio over the past ten years of 23.42, this would result in a Price Target of $71.42 after adjusting for the current premium the stock is trading at with a 2X multiple. The current price as of September 30 is $57.29, giving it a roughly 24.6% upside and our rating of ‘Buy’ for growth-oriented investors.

Risks

It would be senseless to start this section without mentioning recent cuts in growth projections by NextEra Energy Partners (NEP), a subsidiary of NextEra Energy. While it is true that the Fed’s “higher for longer” rhetoric has driven interest rates and the cost of capital higher, thus making it harder to refinance its current debt, there is still a significant possibility that the debt will get rolled up. As their current liabilities measure just 5% of their parent NextEra’s, they will likely look to them to seek more favorable rates on their refinancing.

The real wake-up call comes with the company’s management slashing their dividend guidance in half, indicating incompetence with the current market environment. While this remains a concern for how they will subsequently execute their growth projections, it has triggered a re-evaluation of NextEra’s prospects, which is ultimately good for investors.

Phi Fiscal / CompaniesMarketCap.com

While the “Real Zero” plan does provide a solid and actionable growth trajectory for the company, prior valuations were too far off from reality. Reaching a peak multiple of 65x P/E in March 2023 (compared to an industry average of 23x), investors have a solid reason to believe with this re-evaluation that the company is now more reasonably priced and is subsequently a better buy.

It is also important to note that despite a generally favorable policy backdrop, political risk could increase significantly if the GOP wins the 2024 presidential elections. While specific effects are hard to quantify, the party has generally taken a hostile stance towards newer forms of energy, instead focusing on prioritizing coal and natural gas. This could hinder expansion if it ultimately cuts off Biden-era subsidized loans for development, with federal loans historically being a significant source of funding.

Conclusion

Growth investors should be on the lookout for NextEra as significant expansions occur in the next 5 years, with capacity even being added sooner. With an increase in market share and net income lending itself to more than 24% upside, this is a great growth stock to buy for the long-run, especially as investors adjust to a fairer value following NEEP’s re-evaluation. Although the overall utilities industry is more income-driven, NextEra Energy holds the potential to unlock massive capital appreciation if the regulatory environment and management execute on their growth projections.